Term Plans help you shield your family from uncertainties in life due to financial losses in terms of loss of income that may dawn upon them incase of your untimely demise or critical illness. Securing the future of one's family is one of the most important goals of life. Term Plans go a long way in ensuring your family's financial independence in the event of your unfortunate demise or critical illness. They are all the more important if you are the chief wage earner in your family. No matter how much you have saved or invested over the years, sudden eventualities, such as death or critical illness, always tend to affect your family financially apart from the huge emotional loss.

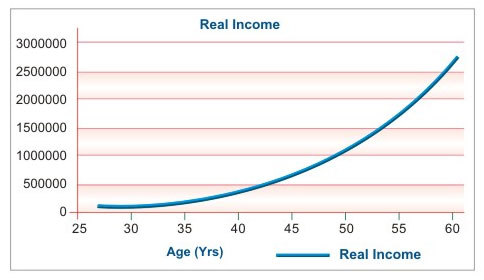

For instance, consider the example of Amit who is a healthy 25 year old guy with a income of Rs. 1,00,000/- per annum. Let's assume his income increases at a rate of 10% per annum, while the inflation rate is around 4%; this is how his income chart will look like, until he retires at the age of 60 years. At 50 years of age, Amit's real income would have been around Rs. 10,00,000/- per annum. However, in case of Amit's unfortunate demise at an early age of 42 years, the loss of income to his family would be nearly Rs. 5,00,000/- per annum.

Childrens Plans helps you save so that you can fulfill your child's dreams and aspirations. These plans go a long way in securing your child's future by financing the key milestones in their lives even if you are no longer around to oversee them. As a parent, you wish to provide your child with the very best that life offers, the best possible education, marriage and life style.

Most of these goals have a price tag attached and unless you plan your finances carefully, you may not be able to provide the required economic support to your child when you need it the most. For example, with the high and rising costs of education, if you are not financially prepared, your child may miss an opportunity of a lifetime.

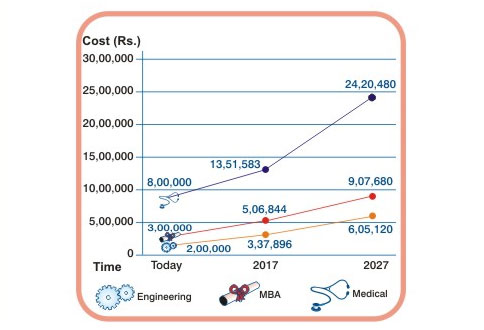

Today, a 2-year MBA course at a premiere management institute would cost you nearly Rs. 3,00,000/- At a assumed 6% rate of inflation per annum, 20 years later, you would need almost Rs. 9,07,680/- to finance your child's MBA degree.

An illustration of how education expenses could rise with passing time due to inflation

So, how can you cope with these costs? Childrens Plans help you save steadily over the long term so that you can secure your child's future needs, be it higher education, marriage or anything else. A small sum invested by you regularly can help you build a decent corpus over a period of time and go a long way in providing your child a secured financial future

Retirement Plans provide you with financial security so that when your professional income starts to ebb, you can still live with pride without compromising on your living standards. By providing you a tool to accumulate and invest your savings, these plans give you a lump sum on retirement, which is then used to get regular income through an annuity plan. Given the high cost of living and rising inflation, employer pensions alone are not sufficient. Pension planning has therefore become critical today.

India's average life expectancy is slated to increase to over 75 years by 2050 from the present level of close to 65 years. Life spans have been increasing due to better health and sanitation conditions in the country. However, the average number of years of employment has not been rising commensurately. The result is an increase in the number of post-retirement years. Accordingly, it has become necessary to ensure regular income for life after retirement, so that you can live with pride and enjoy your twilight years.

You have always given your family the very best. And there is no reason why they shouldn't get the very best in the future too. As a judicious family man, your priority is to secure the well-being of those who depend on you. Not just for today, but also in the long term. More importantly, you have to ensure that your family's future expenses are taken care, even if something unfortunate were to happen to you.

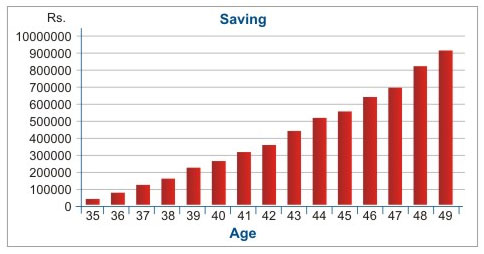

A big factor that you need to consider while building your wealth is inflation. It has a dual impact on your hard-earned savings. Inflation not only erodes your current purchasing power but also magnifies your monetary requirements for the future. Sample this: An 35 Year individual needs to invest Rs. 36,000/- per year with 8% returns to build a corpus of Rs. 10,00,000/- by the age of 50 Years.

However, Rs. 10,00,000/- after 15 years would be worth roughly around half of what it is today once adjusted for inflation at the rate of 4%. Therefore, an individual will need to save nearer to Rs 50,000/- annually to reach your targeted savings at the age of 50 Years, if you consider inflation.

Our Savings & Investment Plans provide you the assurance of lump sum funds for your and your family's future expenses. While providing an excellent savings tool for your short term and long term financial goals, these plans also assure your family a certain sum by way of an insurance cover. With HDFC Standard Life's range of Saving & Investment Plans, you can therefore ensure that your family always remains financially independent, even if you are not around.

Health plans give you the financial security to meet health related contingencies. Due to changing lifestyles, health issues have acquired completely new dimension overtime, becoming more complex in nature. It becomes imperative then to have a health plan in place, which will ensure that no matter how critical your illness is, it does not impact your financial independence.

In the race to excel in our professional lives and provide the best for our loved ones, we sometimes neglect the most important asset that we have-our health. With increasing levels of stress, negligible physical activity and a deteriorating environment due to rapid urbanization, our vulnerability to diseases has increased at an alarming rate.

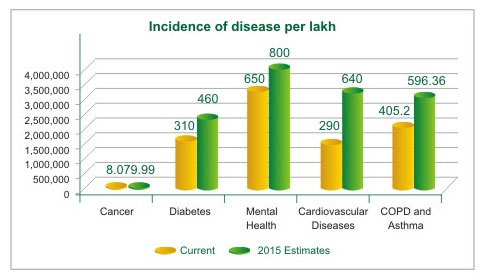

Note: Current figures are for the year 2000(Cardiovascular diseases)), 2001 (COPD and Asthma), 2004 (Cancer) and 2005(Diabetes and Mental Health). All figures above are on a per lakh basis.

As can be seen in the above chart, lifestyle diseases are set to spread at disturbing rates. The result-increased expenditure. In many cases, people need to borrow money or sell assets to cover their medical expenses. All it takes is a suitable plan to help you overcome the financial woes related to your health by paying marginal amounts as premiums. For example, if you are 30 years old, then a mere sum of approximately Rs 3500* annually (exclusive of taxes) can provide you a health insurance plan of Rs 5 lakh over a period of 20 years, and a worry-free future for you and your family.

ARN no:MC/06/2013/3453